latest cryptocurrency news may 2025

- Cryptocurrency market outlook april 2025

- Latest cryptocurrency news april 2025

- Cryptocurrency market analysis february 2025

Latest cryptocurrency news may 2025

Decentralized finance keeps improving because it implements better security systems, which make it suitable for conventional investors while also following regulatory requirements rich palms 60 free spins. Modern lending, borrowing, and yield farming platforms have developed sophisticated features that provide banking alternatives to traditional financial institutions.

Over regulations could slow innovation in the short term, particularly for decentralized platforms and privacy-focused projects. However, the establishment of clear, uniform rules and fair enforcement could enhance trust, attract institutional players, and promote sustainable growth in the long term.

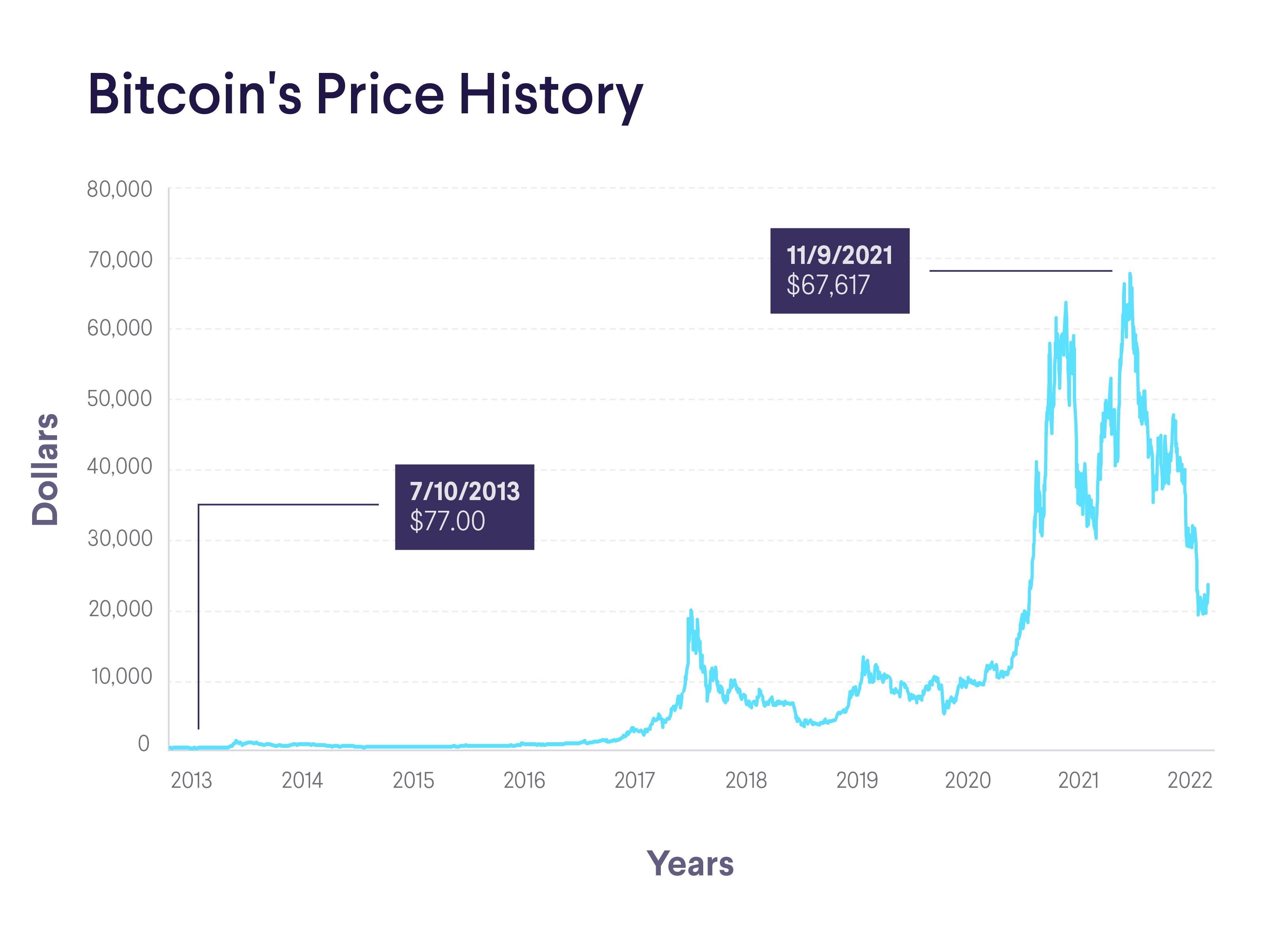

BTC chart analysis for 2025 – The longest term Bitcoin price chart shows that BTC is finally clearing $100k. BTC is now consolidating around the median of its very long term rising channel. The probability that our BTC forecasted prices, both support and bullish targets, will be hit in 2025 is very high.

The marketplace experienced a decrease in non-fungible token (NFT) and metaverse project popularity, although they have now recovered in 2025. Major brands, including Adidas, Nike, and Disney, have returned to the NFT market by offering digital collectibles and virtual experiences. Real utility-based NFT projects recovered investor confidence after the 2021-2022 speculative bubble collapse.

Cryptocurrency market outlook april 2025

Spot crypto ETFs quickly became the fastest growing ETFs in history after their launch in early 2024, recording hundreds of billions in inflows and helping drive the price of bitcoin higher. In the US, 39% of crypto owners said they are invested in a cryptocurrency ETF, up from 37% in 2024.

At least one top wealth management platform will announce a 2% or higher recommended Bitcoin allocation. For a variety of reasons, including seasoning periods, internal education, compliance requirements, and more, no major wealth manager or asset management firm has yet to officially add a Bitcoin allocation recommendation to investment-advised model portfolios. That will change in 2025, and this will further swell the flows and AUM of U.S. spot-based Bitcoin ETPs. -Alex Thorn

The ETH/BTC ratio will trade below 0.03 and also above 0.045 in 2025. The ETH/BTC ratio, one of the most-watched pairs in all of crypto, has been on a perilous downward trend since Ethereum switched to proof-of-stake in September 2022’s “Merge” upgrade. However, anticipated regulatory shifts will uniquely support Ethereum and its app layer, particularly DeFi, re-igniting investor interest in the world’s second-most valuable blockchain network. -Alex Thorn (Note, a prior version of this report said ETHBTC would finish above 0.06, which was a typo).

Stablecoin legislation will pass both houses of Congress and be signed by President Trump in 2025, but market structure legislation will not. Legislation that formalizes and creates a registration and oversight regime for stablecoin issuers in the United States will pass with bipartisan support and be signed into law before the end of 2025. Growing USD-backed stablecoin supply is supportive of dollar dominance and Treasury markets, and when combined with the expected easing of restrictions for banks, trusts, and depositories, will lead to significant growth in stablecoin adoption. Market structure – creating registration, disclosure, and oversight requirements for token issuers and exchanges, or adapting existing rules at the SEC and CFTC to include them – is more complicated and will not be completed, passed, and signed into law in 2025. -Alex Thorn

Looking at a longer timeframe, BTC underwent nearly 14 weeks of consolidation at high levels before breaking down with increased volume. If there is no fundamental change in the environment, such as the Fed accelerating rate cuts, then the bottoming time should not be less than the high-level consolidation time, and may even be longer.

Latest cryptocurrency news april 2025

Litecoin is forecasted to trade between $76.50 and $191.10 in 2025. Litecoin’s 50% Fibonacci retracement level at $128.6 will be essential for confirming bullish trends. Stretched target: $250 (low probability).

Solana has shown positive movement but lacks strong organic demand. Its total value locked (TVL) remains low, raising concerns about network stability. A breakout above $150 with high volume is necessary for further gains and indication of a potential bullish building momentum.

With the bull market getting ready for recovery, a number of cryptos are showing signs of bullish momentum building up as we anticipate a bullish phase in the next few days or weeks.Here are a number of cryptos to watch in April, with the potential to realise huge profits.

The whole of 2025, starting in April 2025, shows key opportunities for crypto investors. The current market trends show promising signs of bullish momentum building up and ready to reverse from the bearish phase.

Litecoin is forecasted to trade between $76.50 and $191.10 in 2025. Litecoin’s 50% Fibonacci retracement level at $128.6 will be essential for confirming bullish trends. Stretched target: $250 (low probability).

Solana has shown positive movement but lacks strong organic demand. Its total value locked (TVL) remains low, raising concerns about network stability. A breakout above $150 with high volume is necessary for further gains and indication of a potential bullish building momentum.

Cryptocurrency market analysis february 2025

In 2025, 24% of respondents in the UK said they were invested in cryptocurrency, up from 18% in 2024. It was the biggest year-over-year jump of any of the nations surveyed. It was also the second highest ownership rate recorded, trailing only Singapore (28%).

After a period of modest growth following the crypto market downturn of 2022, crypto ownership rose in all geographies surveyed over the past year. In particular, crypto ownership in France and the UK surged, reflecting a warming environment for digital assets in Europe.

The initial surge was driven by pro-crypto policies from the U.S. government, including discussions on a national crypto reserve, stablecoin regulations, and potential tax exemptions for crypto-related capital gains.

The key level to watch for PEPE is $0.00000633, which represents PEPE’s 38.2% Fibonacci level acting as a a critical support and potential rebound point. A successful rebound from this level could confirm a lasting bottom. The meme coin’s performance will largely depend on market sentiment and social media trends.

Regulatory clarity and market acceptance will be crucial for XRP to reach the higher end of this spectrum. The expected positive resolution of the battle between Ripple and the SEC is clearly positively impact its trajectory.